Michael Onas

Over-reliance on oil, greed and societal apathy, contributed to Nigeria’s current economic recession and diminished growth. Like a drug addict, Nigeria has relied on oil for 75% of government revenue and 95% of its export incomes. Though it is common for many of Nigeria’s leaders to promise diversification of revenue source, none have made significant or noticeable effort towards such goals.

Due to high oil prices boom, Nigerian economy has expanded at an average rate of 7% a year, which is much higher than the average growth rate in the West African region. Nigeria exports 2m barrels a day, much of it especially prized by refiners for its low sulfur, which makes it easier to meet environmental rules. Unfortunately for Nigeria, 3m barrels of oil production in America since 2011 have been low in sulfur too. As a result, prices for low-sulphur oil have fallen more dramatically than others.

Predictably, as oil revenue continues to drop, Nigeria currency continues its devaluation, though the central bank has tried to stem its decline by selling off its foreign-exchange reserves. As a result, the central bank is now struggling to fund imports into Nigeria. Many governmental agencies, including the Nigerian Ports Authority are now demanding payments in US dollars.

In recent years, industries other than oil, including communications and manufacturing, have begun to thrive in Nigeria and the country’s long-term prospects are promising. However, Nigeria is under tremendous pressure, as it needs an oil price of $120 to balance its budget and this far beyond the current price of $73.70 per barrel.

President Buhari and his cabinet are implementing various measures to curtail corruptions, recovery of looted treasury, minimize excessive spending and limit the impact of the current economic recession in Nigeria.

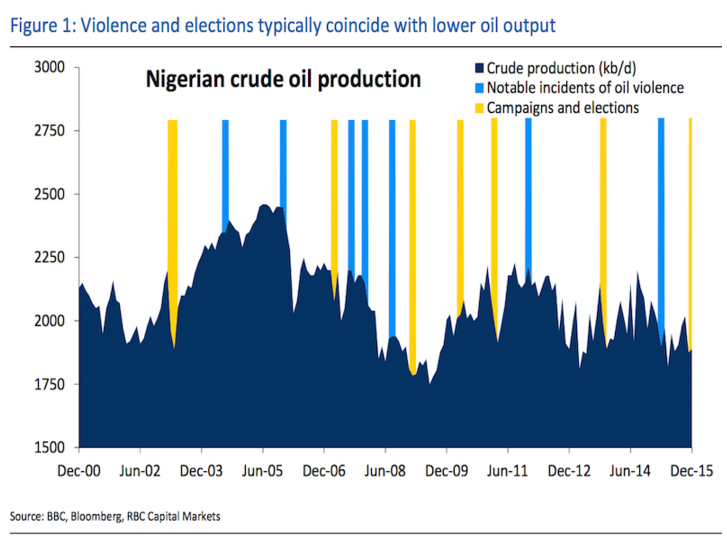

At the same time, the administration is dealing with various militant groups in the oil producing Delta region, who are continuously sabotaging various oil infrastructures to disrupt production. Armed militants, including MEND, routinely kept hundreds of thousands of barrels of oil off the market.

RBC Capital Markets

At the height of its activity, MEND slashed Nigeria’s oil output by 50%, cost the government $19 million in daily defense outlays, and claimed an estimated 1,000 lives per year, according to data cited by RBC Capital Markets.

Various militant groups have bombed a sub-sea pipeline to Shell’s Forcados export terminal, thereby closing off 250,000 barrels of oil exports per day and sharply reduced gas supplies to local power plants.

“Nigerian production has been slowly grinding lower over recent years, even absent acute outages due to natural declines, and this will be compounded over the next several years given the number of shelved projects” wrote Helima Croft, RBC Capital Markets’ head of global commodity strategy.

Militants wearing black masks patrol the creeks of the Niger Delta area of Nigeria. (File photo)

In recent week, President Buhari deployed the Nigerian airforce to the affected areas to address the ongoing interuption and sabotage of oil pipelines.

In closing, Nigeria should take this opportunity to implement measures towards diversification of its economy, away from declining oil reserve.